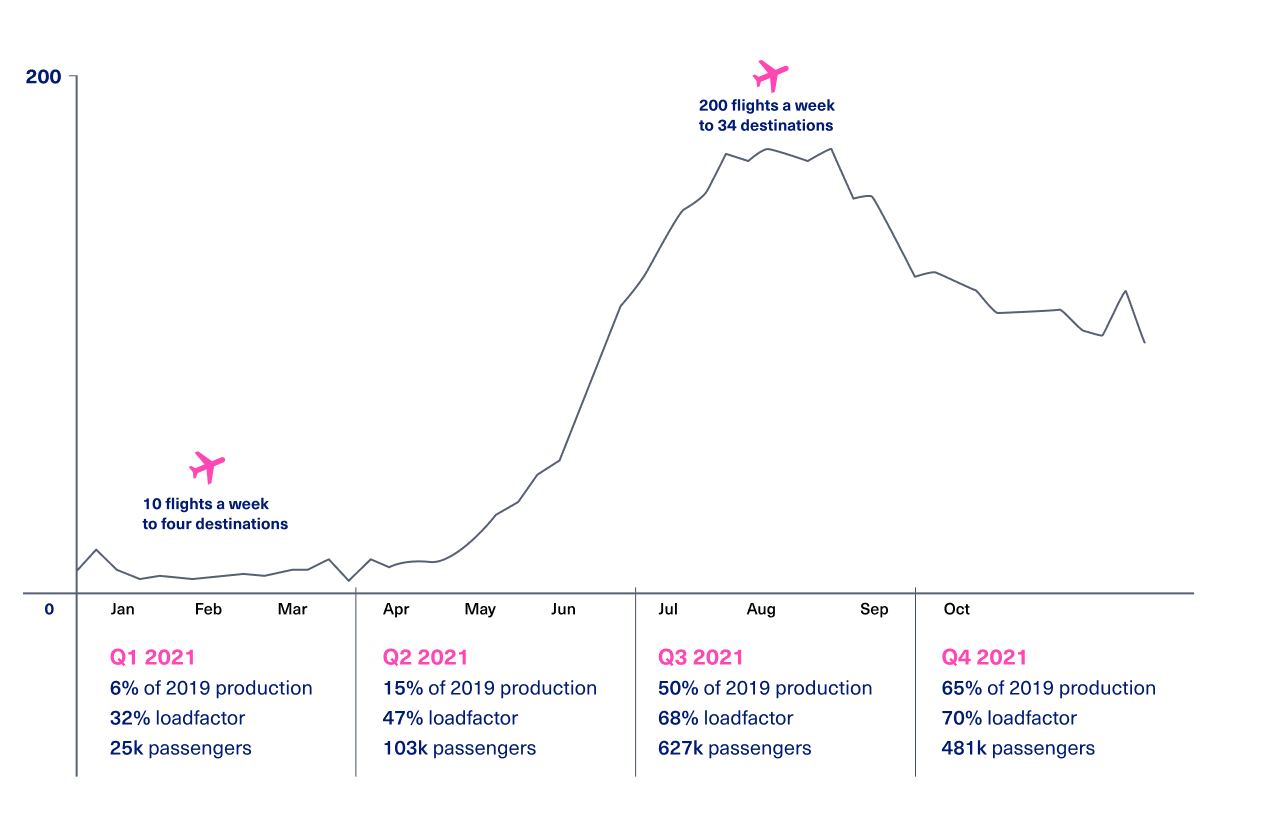

After having focused on preserving our infrastructure, knowledge and maintaining financial strength throughout the pandemic, Icelandair was in a strong position for an efficient ramp-up as soon as passenger demand started to increase in 2021. The first half of the year progressed slowly; and then came the turnaround in the second half with improvements in terms of operating income and profitability. The Company turned a profit from regular operations in the third quarter for the first time in two years.

Net loss for the year amounted to USD 104.8 million compared to a loss of USD 376.2 million in 2020. EBIT was negative of USD 135.9 million compared to negative EBIT of USD 363.0 million in 2020. Cargo operations were strong with volumes and revenues exceeding pre-Covid levels, especially on the transit market. Although the leasing operation was challenging during the year, new opportunities were seized on this front that contributed to the Company´s revenue generation.